do i have to pay estimated taxes for 2020

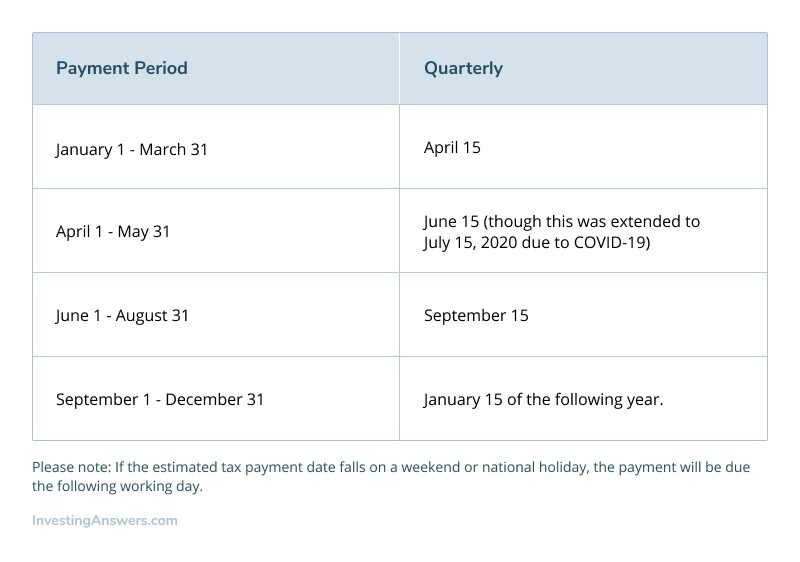

4th quarter January 15th 2021. Therefore the regular systems and dates for making estimated tax payments have been adjusted too.

Tax Deadlines For Expats H R Block

Do you expect your federal income tax withholding plus any estimated taxes paid on time to amount to at least 90 percent of the total tax that you will owe for this tax year.

. Each payment must be made by the deadline. Income taxes must generally be paid as you earn or receive income throughout the year either through withholding or estimated tax payments. Well get your books in order and take care of federal tax forms youll.

Estimated tax is the amount of tax an estate or trust expects to owe for the year after subtracting. 3rd quarter September 15th 2020. If so then youre in the clear and you dont need to make estimated tax payments.

1st quarter payment due July 15th 2020. An estimate of your 2022 income. Is it too late to pay estimated taxes for 2020.

The amount of any tax withheld. The IRS says you need to pay estimated quarterly taxes if you expect. There are four equal payment deadlines for this tax season.

Is it too late to pay estimated taxes for 2021. If the amount of income tax withheld from your salary or pension is not enough or if you receive other types of income such as interest dividends alimony self-employment income capital gains prizes and awards you. If they dont they may owe an estimated tax penalty.

If so youre safeyou dont need to make estimated tax payments. Youll owe at least 1000 in federal income taxes this year even after accounting for your withholding and refundable credits. You dont have to make estimated tax payments until you have income on which you will owe tax.

Fiscal year farmers and fishermen. The tool is designed for taxpayers who were US. The IRS says you need to pay estimated quarterly taxes if you expect.

The United States income tax system is a pay-as-you-go tax system which means that you must pay income tax as you earn or receive your income during the year. Taxpayers can review these forms for help figuring their estimated payments. About Form 1041-ES Estimated Income Tax for Estates and Trusts.

Do I have to pay estimated taxes for 2020. The amount of any credits. The amended due dates for estimated tax payments for 2020 are as follows.

If you meet these IRS minimums then youll likely have to file estimated quarterly taxes. If youre a calendar year taxpayer and you file your 2022 Form 1040 by March 1 2023 you dont need to make an estimated tax payment if you pay all the tax you owe at that time. In most cases you must pay estimated tax for 2020 if both of the following apply.

Youll owe at least 1000 in federal income taxes this year even after accounting for your withholding and refundable credits. Freelancers contractors and others whose earnings are reported on a 1099 instead of a W-2 also need to pay estimated taxes. 90 of the tax to be shown on your 2020 tax return or b.

Do I have to pay estimated taxes for 2020. Do I have to pay estimated taxes for 2020. Note that special rules.

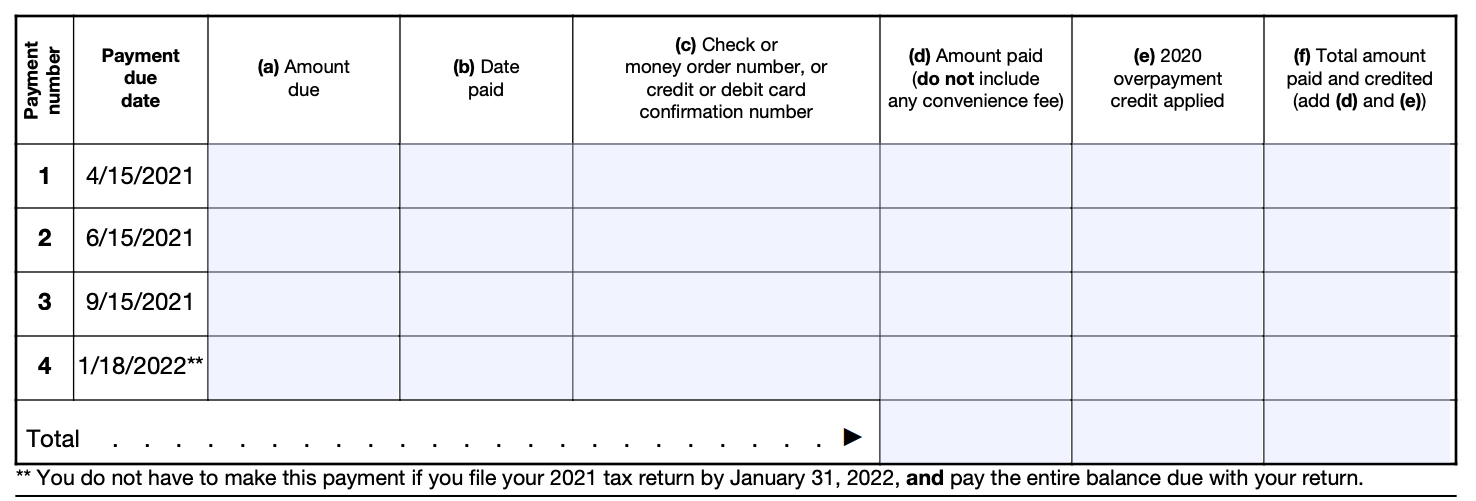

The remaining deadlines for paying 2020 estimated taxes are September 15 2020 and January 15 2021. 100 of the tax shown on your 2019 tax return. Form 1040-ES Estimated Tax for Individuals.

You expect your withholding and refundable credits to be less than the smaller of. This interview will help you determine if youre required to make estimated tax payments for 2022 or if you meet an exception. Who has to pay estimated taxes.

The IRS says you need to pay estimated quarterly taxes if you expect. The deadline to file Form NC-40 online to pay estimated taxes for the year 2020 is April 15. If you expect to owe more than 1000 in additional taxes after calculating your withholding and refundable credits for the year the IRS says you must pay estimated taxes.

You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. You probably have to pay estimated taxes if you file as a self-employed individual a sole proprietor a partnership or an S corporation shareholder. Your 2021 income tax return.

If you didnt pay enough tax throughout the year either through withholding or by making estimated tax payments you may. Use Form 1041-ES to figure and pay estimated tax for an estate or trust. Citizens or resident aliens for the entire tax year for which theyre inquiring.

Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding estimated tax payments or a combination of the two. You expect to owe at least 1000 in tax for 2020 after subtracting your withholding and refundable credits. Youll owe at least 1000 in federal income taxes this year even after accounting for your withholding and refundable credits.

17 2018 and Jan. If you need some help with your estimated taxes check out Bench. For tax-year 2018 the remaining estimated tax payment due dates are Sept.

If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax year or at least 100 percent of the total tax on your previous years return 110 percent for AGIs greater than 75000 for single and separate filers and 150000 for married filing joint you most likely will not need. Each payment is due on April 15 June 15 September 15 and January 15. 2nd quarter July 15th 2020.

So for example if you dont have any taxable income until July 2021 you dont have to make an estimated tax payment until September 15 2021. Businesses that file as a corporation generally need to make estimated tax payments if they expect to owe 500 or more in tax for the current year. Corporations generally must make these payments if they expect to owe 500 or more on their 2020 tax return.

You can do this either through withholding or by making estimated tax payments.

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2022 1040 Es Form And Instructions 1040es

Solved How Do You Categorize An Estimated Tax Payment On Qb I Know It S Not An Expense What Is It

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Fiscal Quarters Q1 Q2 Q3 Q4 Investinganswers

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

Safe Harbor For Underpaying Estimated Tax H R Block

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

What Happens If You Miss A Quarterly Estimated Tax Payment

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimated Tax Payments For Independent Contractors A Complete Guide

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard

Do You Need To Pay Income Tax Instalments Personal Tax Advisors

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa