how are rsus taxed at ipo

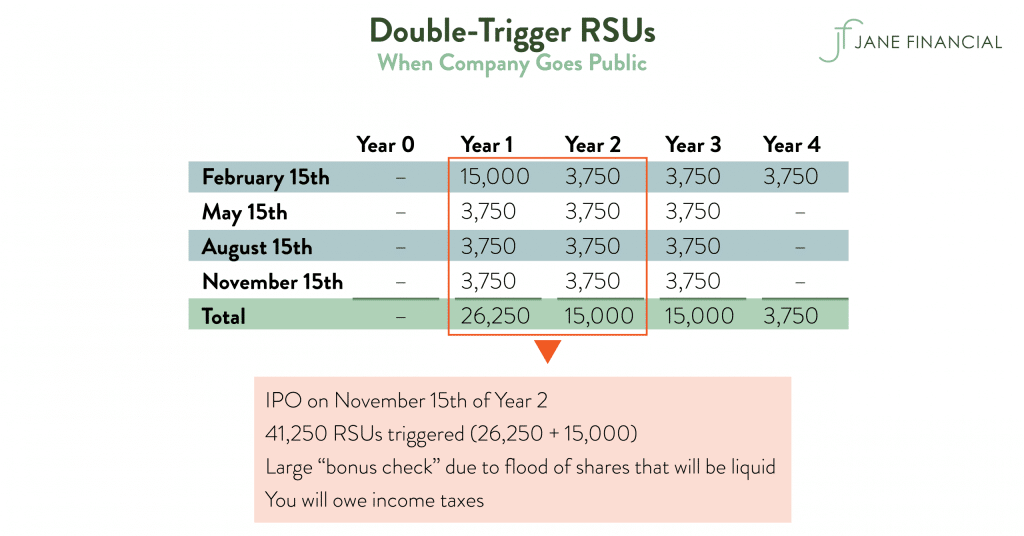

All your vested RSUs will be granted on the day of IPO so you will have only 1 vesting event. When RSUs are issued to an employee or executive they are subject to ordinary income tax.

Rsu Taxes Explained 4 Tax Strategies For 2022

How do employees handle income taxes on pre-ipo vested rsus.

. In examples like Airbnb Doordash etc. RSUs can trigger capital gains tax but only if the. FICA taxes and all.

However the year all your RSUs vest can still be a really good year to make charitable contributions. Once shares vest they. If a company is already public RSUs are usually taxable when they.

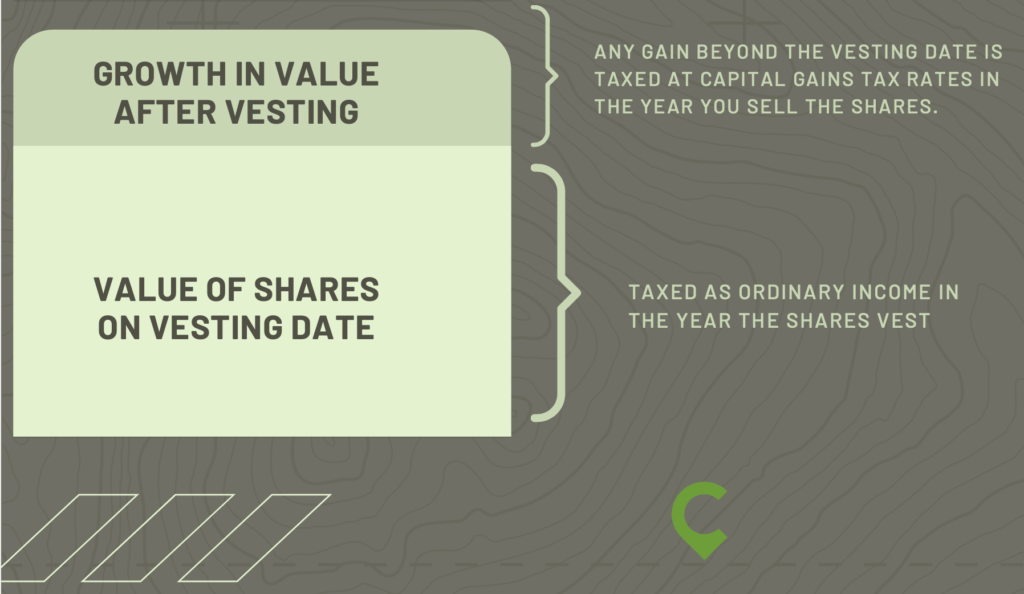

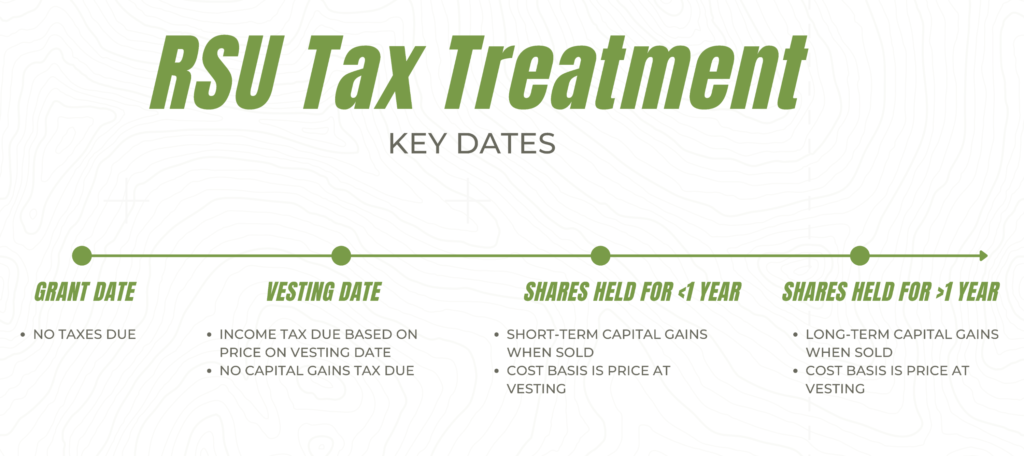

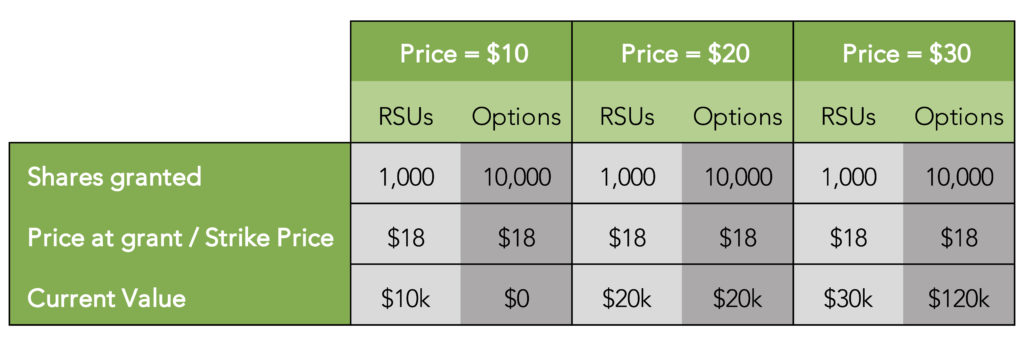

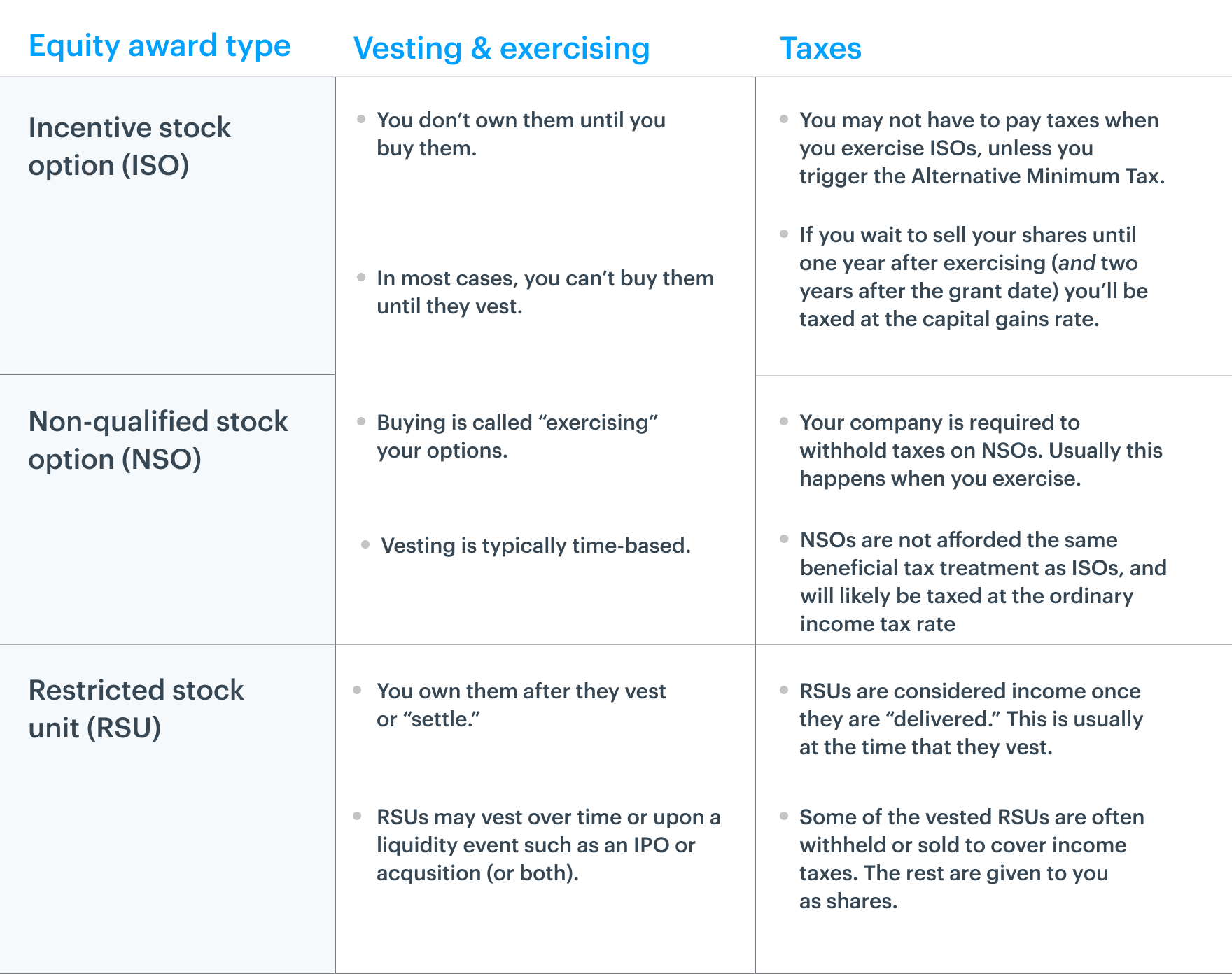

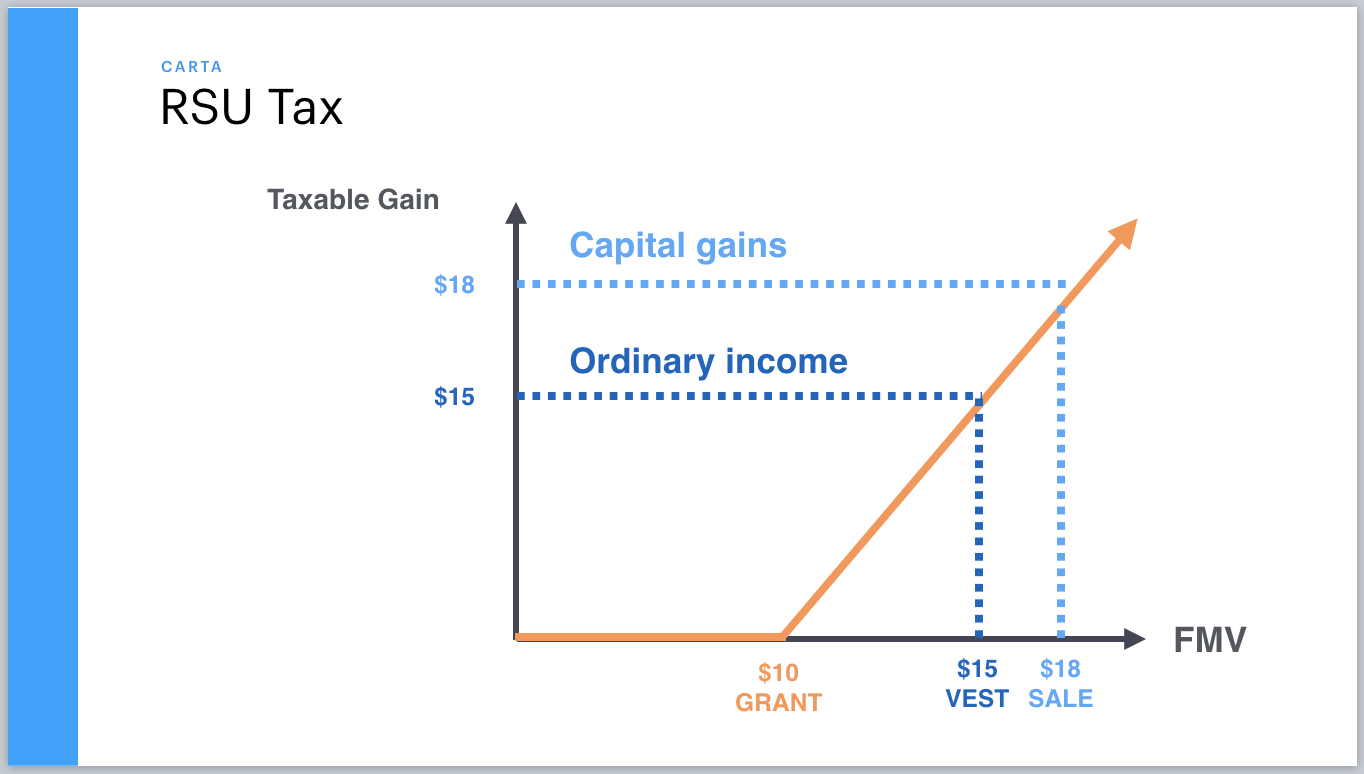

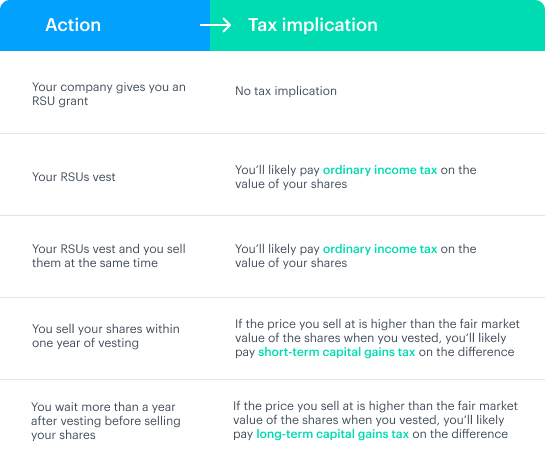

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. With RSUs there are no decisions to be made except for when you sell them. When shares are sold the difference in.

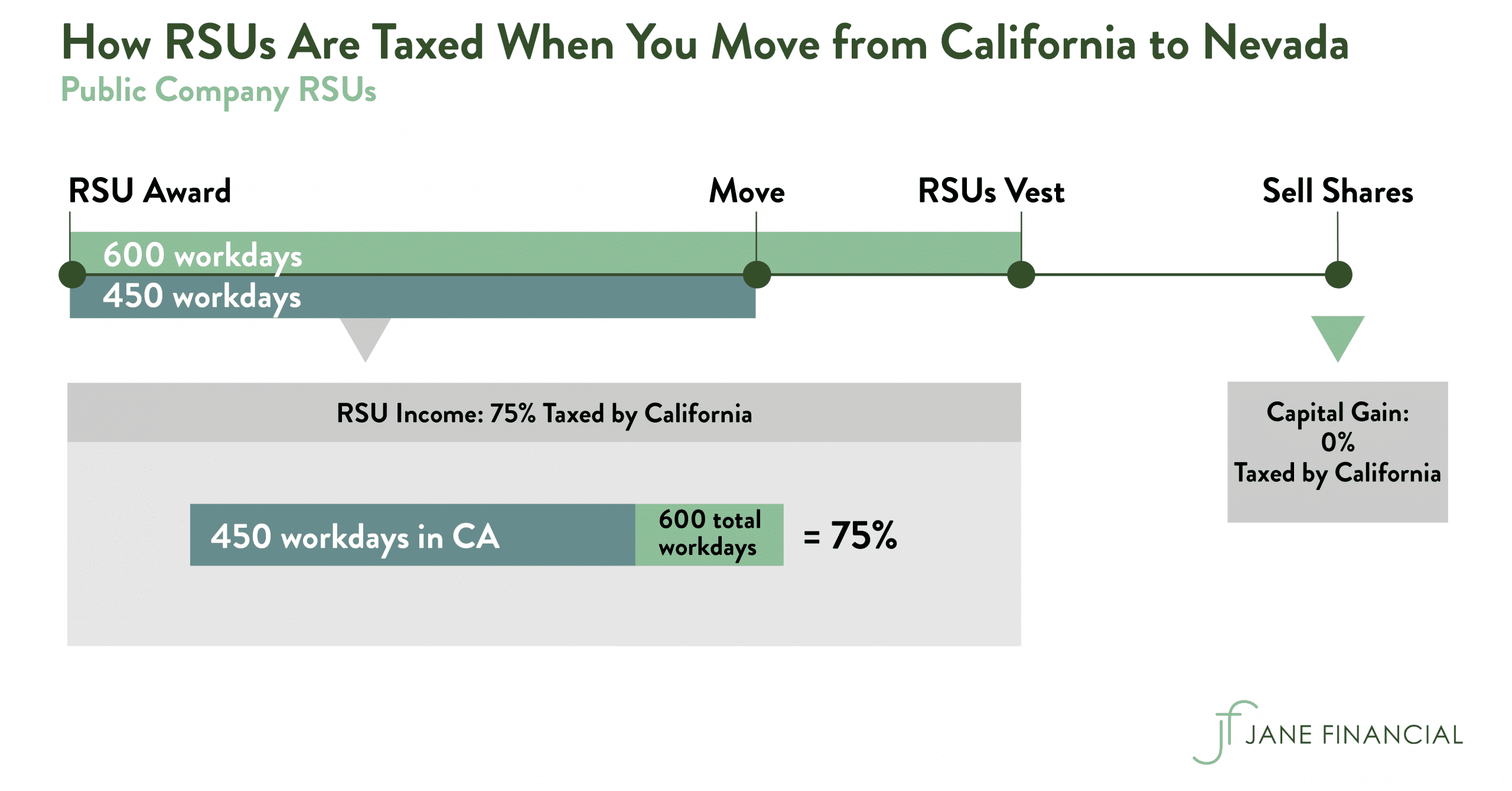

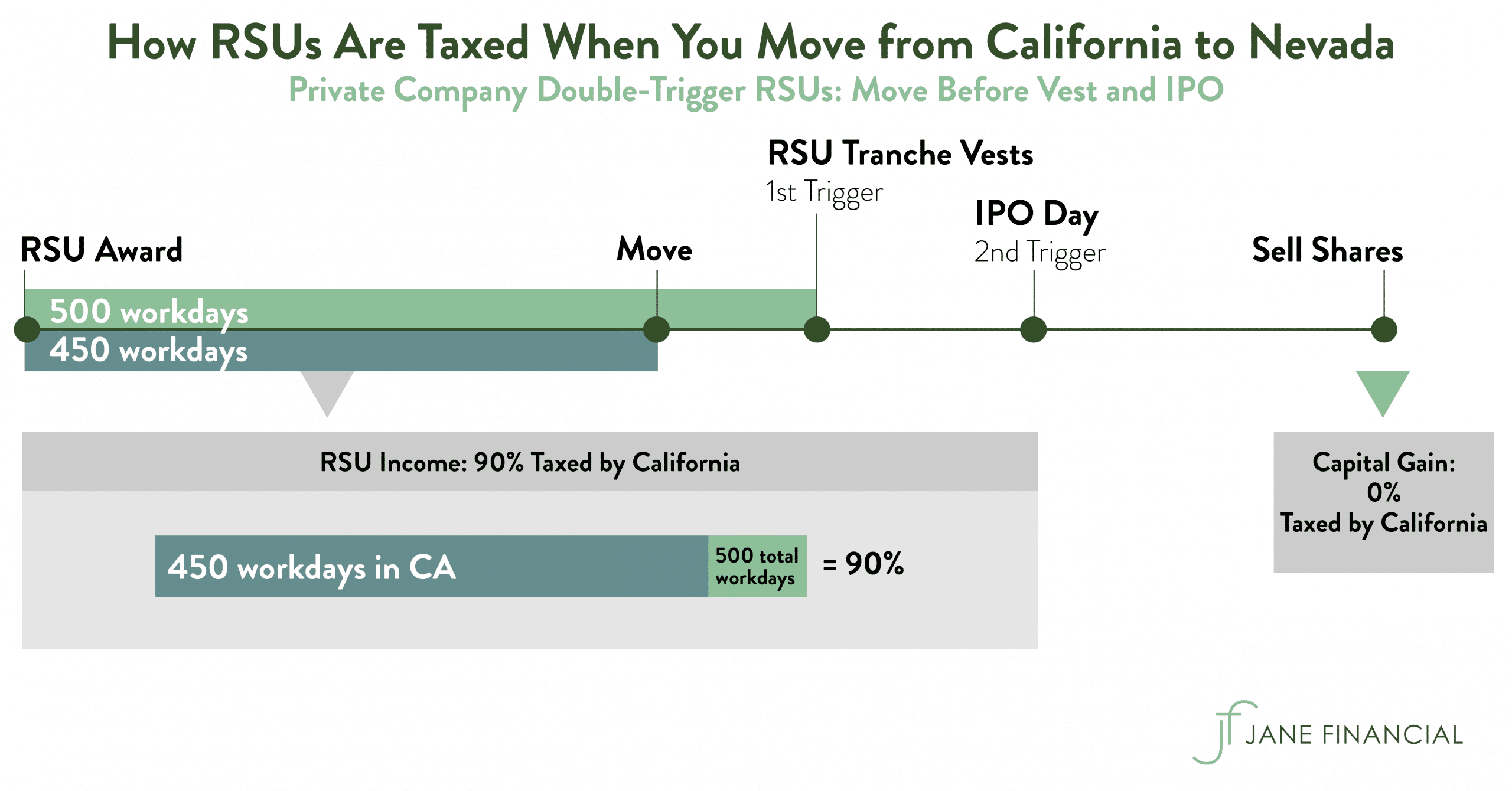

For estimating taxes for IPOs. However in the case where the company requires or a participant elects a deferred. They have to pay taxes on a 72 tax basis based on the price that the IPO happened and the shares vested.

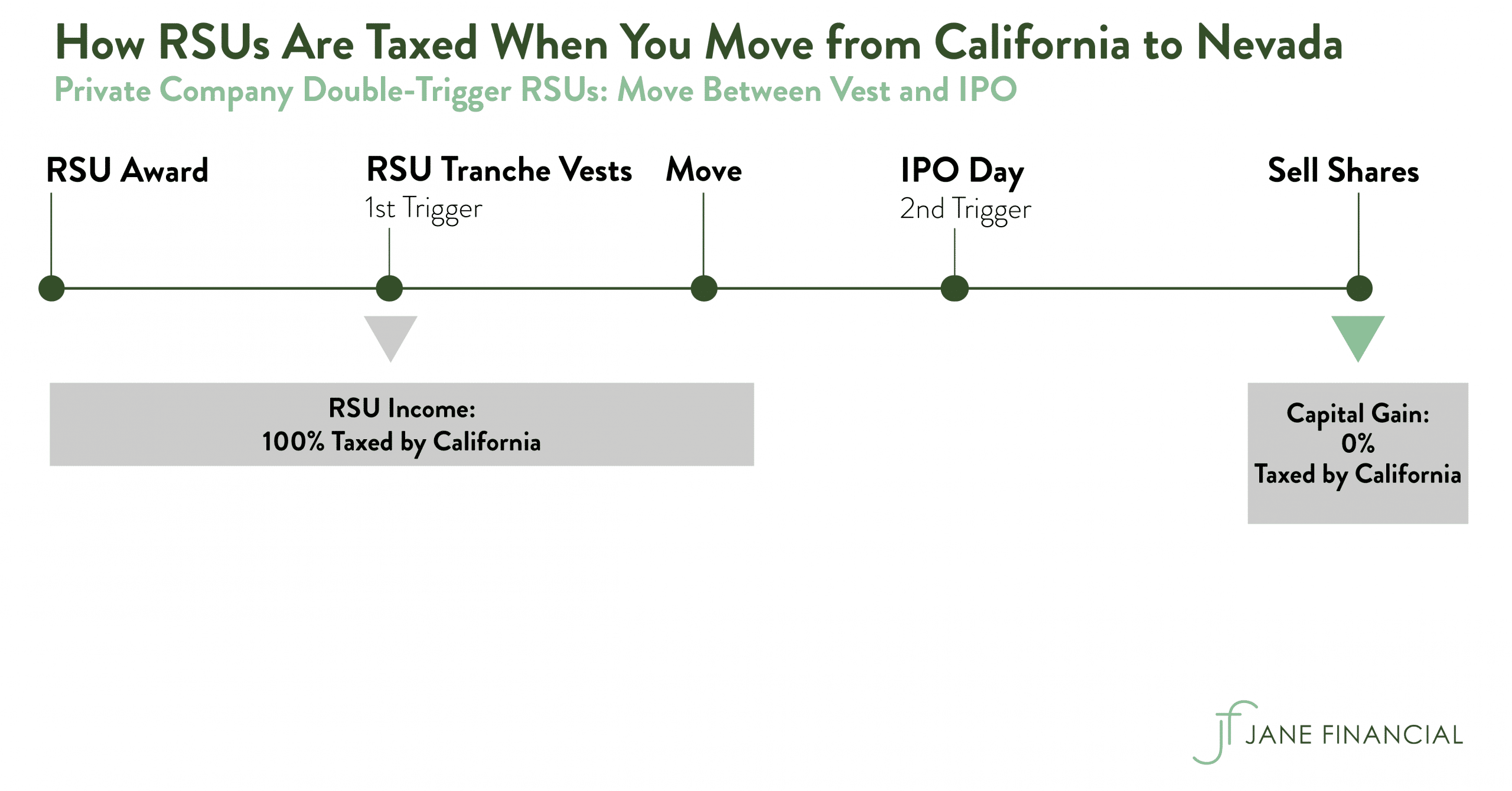

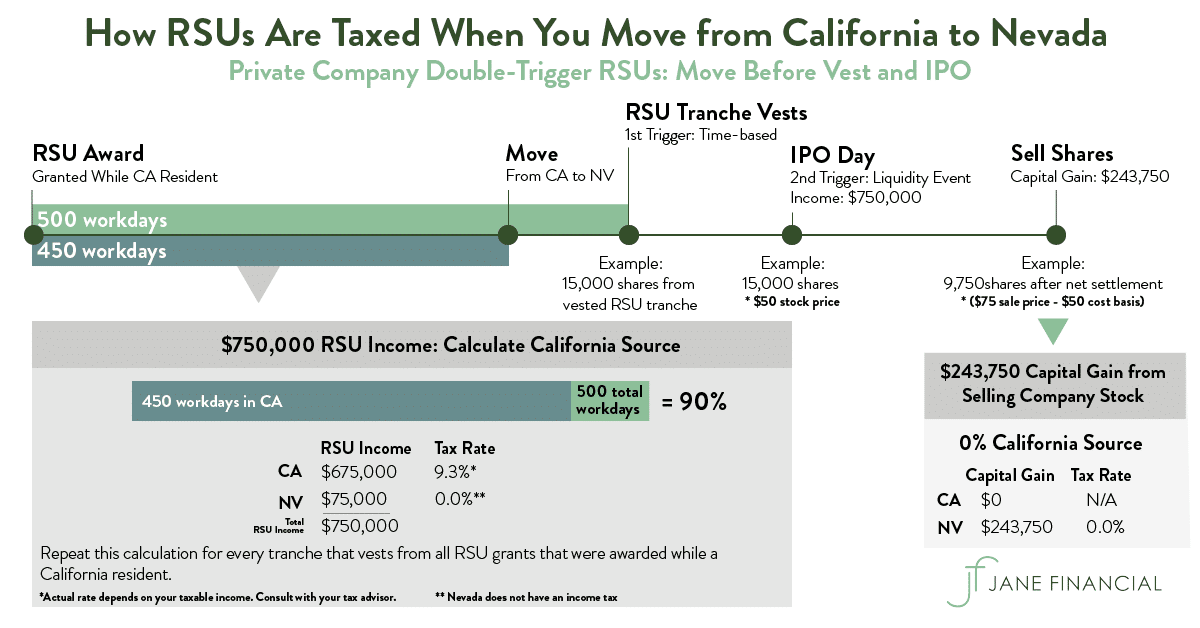

Once they vest they get taxed and they are in your possession. Usually time is the first trigger and an event such as an IPO or a company acquisition is the second and final trigger explained Meredith Johnson. However you can either file an 83 i to defer taxes or sacrifice a portion of the shares to cover taxes.

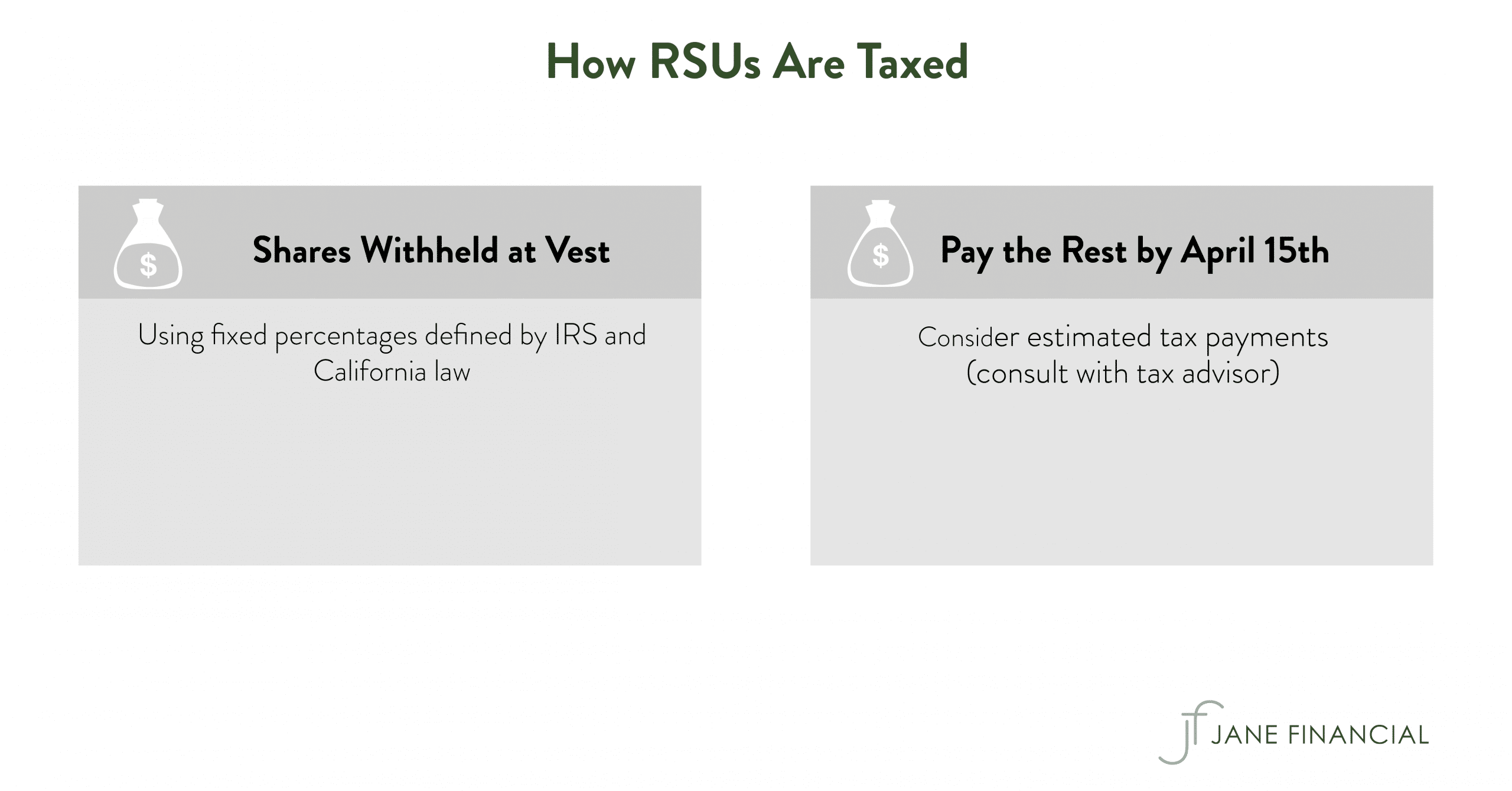

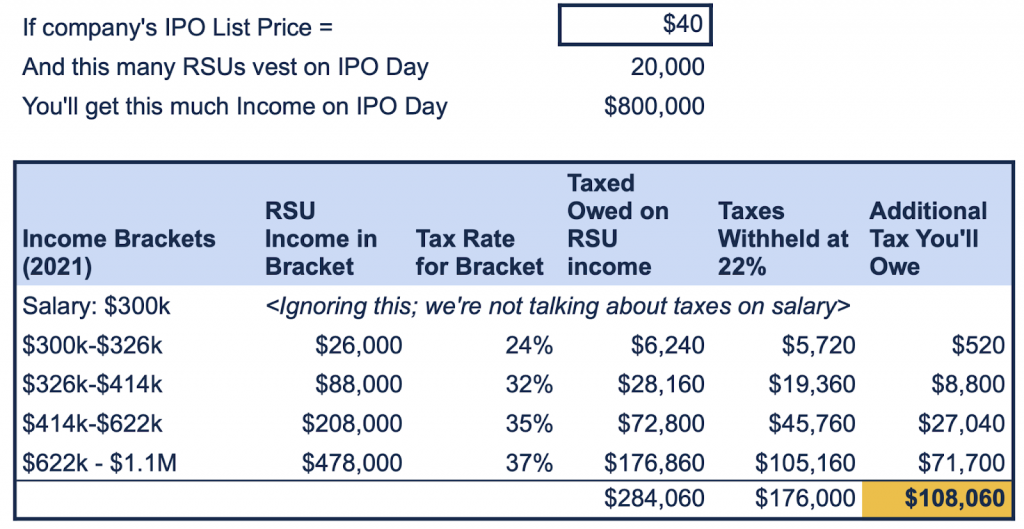

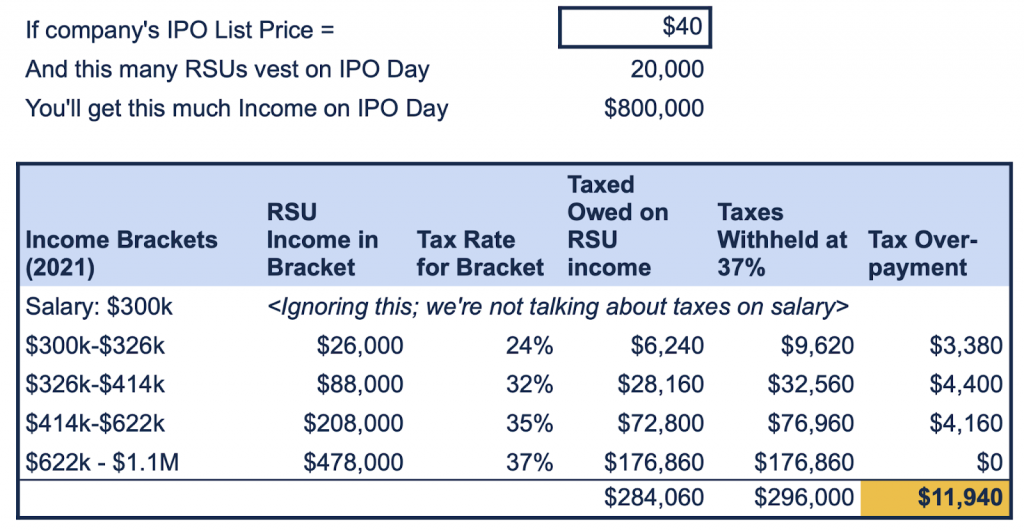

If your company grants you RSUs the total amount vested at the time of IPO is classified as supplemental income and is taxed at the regular income tax bracket rate. Capital gains tax only applies if the recipient of RSUs does not sell the stock. Since RSUs are taxed upon transfer of shares to the participant this is commonly at vest.

Your company has its IPO. How are RSUs taxed. Your RSUs vest and become taxable 180 days after Event 2.

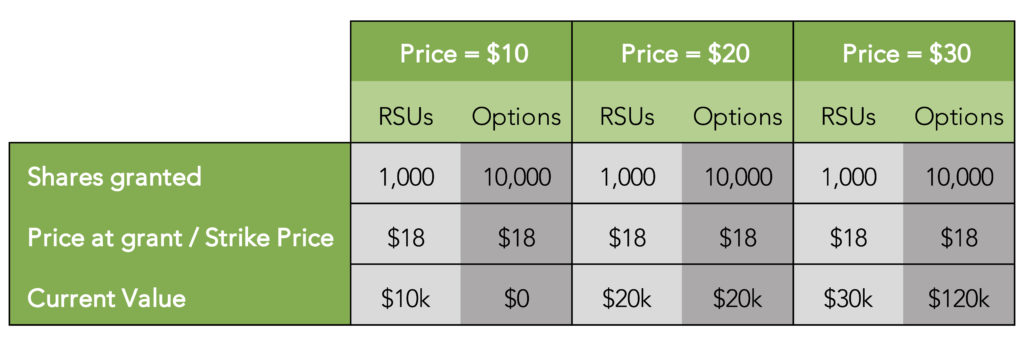

Because if all of your RSUs vest at once you might get pushed. An IPO triggers taxes for RSUs even if you arent ready to sell the shares. With RSUs if 300 shares vest at 10 a share selling yields 3000.

Crucially you cannot control the timing. Even if the share price drops to 5 a share you could still make 1500. The two types of stock.

72 54 an 18. Are they double trigger vestliquidity event 83i or do employees have to. However when they sell theyll only get 54 each.

Input all the shares vested and the IPO price in the boxes below. You are granted some RSUs. RSUs at IPO - Potential Risks and Pitfalls to Look Out For IPO Pitfall 1 - Taxes Withholding Preferences.

Gains on RSU stocks are taxed at the capital gains tax rate. In contrast two types of stock options exist and are taxed differently from one another. The fair market value of RSUs is taxable as ordinary income on the date that shares are actually transferred to the employee.

The Mystockoptions Blog Pre Ipo Companies

Restricted Stock Units Jane Financial

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

How Equity Holding Employees Can Prepare For An Ipo Carta

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Strategies For 2022

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc